User Guide

Table of contents

- Introduction

- Quick start

- Features

- FAQ

- Command Summary

Introduction

Financial Planner is a Command Line Interface (CLI) application for managing your finances conveniently. It is optimized for use via the CLI and leverages your expertise in CLI and your ability to type fast and gives you a one-stop interface to access a plethora of features to manage your finances.

Quick Start

- Ensure that you have Java 11 or above installed.

- Download the latest version of

Financial Plannerfrom here. - Copy the file to the folder you want to use as the home folder for Financial Planner.

- Open a command terminal,

cdinto the folder you put the jar file in, and use thejava -jar tp.jarcommand to run the application. - Refer to the Features section below for details of each command.

Features

Notes about the command format

-

Words in

UPPER_CASEare parameters to be supplied by the user.e.g. in

add income /a AMOUNT,AMOUNTis a parameter which can be used asadd income /a 100. -

Items in square brackets are optional.

e.g.

[/r DAYS]can be used as/r 30or left empty.

Notes about naming convention

- Cashflow refers to an income or expense.

Notes about program limitations

- Maximum amount for each cashflow and total balance that the program can hold is 999,999,999,999.99

- Minimum amount for each cashflow and total balance that the program can hold is -999,999,999,999.99

- Total Balance, Income balance, and Expense balance are different entities where the latter two do not have the same limitations.

- Maximum value for recurrences and indexes is 2,147,483,647, the maximum number an

intcan hold.

Important: Data is automatically loaded on start up and saved when exited. You must exit the program using the exit command in order to save your data.

Add cashflow

Add income: add income

Adds an income source to the Financial Planner.

Format: add income /a AMOUNT /t TYPE [/r DAYS] [/d DESCRIPTION]

/ais used to specify the amount of the income, where an integer or double is expected./ris used to denote a recurring income, with the period to the next addition is specified by an integer representing the number ofDAYS./dis used to give a description to the income, where any String is expected./tis used to specify the income type, where the list of acceptable types is given below. The types are case-insensitive.

| Income Types |

|---|

salary |

investments |

allowance |

others |

Example of usage: add income /a 5000 /t salary /r 30 /d work

Example output:

You have added an Income

Type: Salary

Amount: 5000.00

Recurring every: 30 days, date added: Nov 04 2023, recurring on: Dec 04 2023

Description: work

to the Financial Planner.

Balance: 5000.00

- Note: Balance displayed above is just an example. Your actual balance may differ.

- Note: Date displayed above is just an example. Your actual date may differ.

Add expense: add expense

Adds an expense to the Financial Planner

Format: add expense /a AMOUNT /t TYPE [/r DAYS] [/d DESCRIPTION]

/ais used to specify the amount of the expense, where an integer or double is expected./ris used to denote a recurring expense, with the period to the next addition is specified by an integer representing the number ofDAYS./dis used to give a description to the expense, where any String is expected./tis used to specify the expense type, where the list of acceptable types is given below. The types are case-insensitive.

| Expense |

|---|

dining |

entertainment |

shopping |

travel |

insurance |

necessities |

others |

Example of usage: add expense /a 300 /t necessities /r 30 /d groceries

Example output:

You have added an Expense

Type: Necessities

Amount: 300.00

Recurring every: 30 days, date added: Nov 04 2023, recurring on: Dec 04 2023

Description: groceries

to the Financial Planner.

Balance: 4700.00

- Note: Balance displayed above is just an example. Your actual balance may differ.

- Note: Date displayed above is just an example. Your actual date may differ.

List

List all: list

Lists all cashflows.

Format: list

Example of usage: list

Example output:

You have 4 matching cashflows:

1: Expense

Type: Dining

Amount: 30.00

Description: Genki Sushi

2: Expense

Type: Necessities

Amount: 300.00

Recurring every: 30 days, date added: Nov 04 2023, recurring on: Dec 04 2023

Description: groceries

3: Income

Type: Allowance

Amount: 500.00

Recurring every: 30 days, date added: Nov 04 2023, recurring on: Dec 04 2023

4: Income

Type: Investments

Amount: 1000.00

Balance: 1170.00

- Note: Balance displayed above is just an example. Your actual balance may differ.

- Note: Date displayed above is just an example. Your actual date may differ.

List income: list income

Lists all incomes.

Format: list income

Example of usage: list income

Example output:

You have 3 matching cashflows:

1: Income

Type: Allowance

Amount: 500.00

Recurring every: 30 days, date added: Nov 04 2023, recurring on: Dec 04 2023

2: Income

Type: Investments

Amount: 1000.00

3: Income

Type: Salary

Amount: 100.00

Income Balance: 1600.00

- Note: Balance displayed above is just an example. Your actual balance may differ.

- Note: Date displayed above is just an example. Your actual date may differ.

List expense: list expense

Lists all expenses.

Format: list expense

Example of usage: list expense

Example output:

You have 3 matching cashflows:

1: Expense

Type: Dining

Amount: 30.00

Description: Genki Sushi

2: Expense

Type: Necessities

Amount: 300.00

Recurring every: 30 days, date added: Nov 04 2023, recurring on: Dec 04 2023

Description: groceries

3: Expense

Type: Others

Amount: 0.23

Expense Balance: 330.23

- Note: Balance displayed above is just an example. Your actual balance may differ.

- Note: Date displayed above is just an example. Your actual date may differ.

List recurring: list recurring

Lists all recurring cashflows.

Format: list recurring

- This list will not include any cashflow that has already recurred.

Example of usage: list recurring

Example output:

You have 4 matching cashflows:

1: Expense

Type: Necessities

Amount: 300.00

Recurring every: 30 days, date added: Nov 04 2023, recurring on: Dec 04 2023

Description: groceries

2: Income

Type: Salary

Amount: 5000.00

Recurring every: 30 days, date added: Nov 04 2023, recurring on: Dec 04 2023

Description: work

3: Expense

Type: Necessities

Amount: 300.00

Recurring every: 30 days, date added: Nov 04 2023, recurring on: Dec 04 2023

Description: groceries

4: Income

Type: Allowance

Amount: 500.00

Recurring every: 30 days, date added: Nov 04 2023, recurring on: Dec 04 2023

- Note: Date displayed above is just an example. Your actual date may differ.

Delete cashflow: delete

Deletes a cashflow from the Financial Planner.

Format: delete INDEX [/r]

INDEXrefers to the index number shown in the displayed list whenlistcommand is used./ris used to delete all future cashflows only.

Example of usage: delete 1 /r

Example output:

You have removed future recurrences of this cashflow.

Updated cashflow:

Income

Type: Salary

Amount: 5000.00

Description: work

Example of usage: delete 1

Example output:

You have removed an Income

Type: Salary

Amount: 5000.00

Description: work

from the Financial Planner.

Balance: -1130.00

- Note: Balance displayed above is just an example. Your actual balance may differ.

Delete income: delete income

Deletes an income from the Financial Planner.

Format: delete income INDEX [/r]

INDEXrefers to the index number shown in the displayed list whenlist incomecommand is used./ris used to delete all future incomes only.

Example of usage: delete income 2 /r

Example output:

You have removed future recurrences of this cashflow.

Updated cashflow:

Income

Type: Allowance

Amount: 500.00

Description: parents

Example of usage: delete income 2

Example output:

You have removed an Income

Type: Allowance

Amount: 500.00

Description: parents

from the Financial Planner.

Balance: 5170.00

- Note: Balance displayed above is just an example. Your actual balance may differ.

Delete expense: delete expense

Deletes an expense from the Financial Planner.

Format: delete expense INDEX [/r]

INDEXrefers to the index number shown in the displayed list whenlist expensecommand is used./ris used to delete all future expenses only.

Example of usage: delete expense 2 /r

Example output:

You have removed future recurrences of this cashflow.

Updated cashflow:

Expense

Type: Insurance

Amount: 800.00

Description: ntuc income

Example of usage: delete expense 2

Example output:

You have removed an Expense

Type: Insurance

Amount: 800.00

Description: ntuc income

from the Financial Planner.

Balance: -330.00

- Note: Balance displayed above is just an example. Your actual balance may differ.

Delete recurring: delete recurring

Deletes a recurring cashflow from the Financial Planner.

Format: delete recurring INDEX [/r]

INDEXrefers to the index number shown in the displayed list whenlist recurringcommand is used./ris used to delete all future recurring cashflows only.

Example of usage: delete recurring 2 /r

Example output:

You have removed future recurrences of this cashflow.

Updated cashflow:

Expense

Type: Insurance

Amount: 800.00

Description: ntuc income

Example of usage: delete recurring 1

Example output:

You have removed an Expense

Type: Necessities

Amount: 300.00

Recurring every: 30 days, starting from: Oct 30 2023

Description: groceries

from the Financial Planner.

Balance: -830.00

- Note: Balance displayed above is just an example. Your actual balance may differ.

- Note: Date displayed above is just an example. Your actual date may differ.

Find cashflow: find

Finds a cashflow using keywords

Format: find <keyword>

Example of usage: find buy coffee

Viewing balance: balance

View user’s current balance.

Format: balance

Example of usage: balance

Example output:

Balance: 3790.00

Budget

Setting a budget: budget set

Sets a monthly budget.

Format: budget set /b BUDGET

BUDGEThas to be a positive number.

Example of usage: budget set /b 500

Example output:

A monthly budget of 500.00 has been set.

Updating budget: budget update

Updates initial budget to a new value. Current(remaining) budget will be updated accordingly. If new initial budget is lower(higher), the new current budget will be lower(higher) by the same amount.

Format: budget update /b BUDGET

Budgethas to be a positive number.- There has to be an existing budget.

Example of usage: budget update /b 1000

Example output:

Budget has been updated:

Old initial budget: 500.00

Old current budget: 500.00

New initial budget: 1000.00

New current budget: 1000.00

Resetting budget: budget reset

Resets current budget to initial budget if they are different.

Format: budget reset

- Budget will be reset to initial budget or current balance, whichever is lower.

Example of usage: budget reset

Example output:

Budget has been reset to 1000.00.

Deleting budget: budget delete

Deletes existing budget.

Format: budget delete

Example of usage: budget delete

Example output:

Budget has been deleted.

Viewing budget: budget view

View existing budget.

Format: budget view

Example of usage: budget view

Example output:

You have a remaining budget of 1000.00.

Displaying overview: overview

Displays an overview of user’s financials.

Format: overview

Example of usage: overview

Example output:

Here is an overview of your financials:

Total balance: 5450.00

Highest income: 5000.00 Category: Salary

Highest expense: 50.00 Category: Others

Remaining budget for the month: 50.00

Reminders:

No reminders added yet.

Wishlist:

No goals added yet.

Viewing Watchlist: watchlist

- Note: Stockcode and symbol will be used interchangeably and have the same meaning

- Note: Watchlist feature requires a stable internet connection

View your current watchlist with stocks that you are interested in with the exchanges shown as well

Default watchlist: AAPL, GOOGL

These stocks will be added to the watchlist automatically if:

- your watchlist file is corrupted, and you chose to override it

- your watchlist is empty on startup

Format: watchlist

Example of usage: watchlist

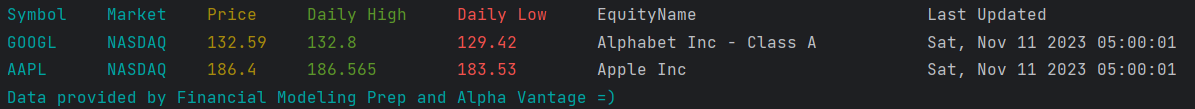

Example of output:

- Note: Your watchlist information is saved under the file path

data/watchlist.jsonin JSON format - Note: the watchlist in memory is saved to the file whenever you run

watchlistcommand orexitcommand

Format of watchlist output:

| Symbol | Market | Price | Daily High | Daily Low | Equity Name | Last Updated |

|---|---|---|---|---|---|---|

| Ticker Symbol (Abbreviation for Company ‘s Stocks) |

Exchange at which the stock is traded | Current latest price of stock (before closing) | Intraday Highest trading price | Intraday Lowest trading price | Name of equity product | Last time at which the information of the stocks was updated by the API |

- Note: To prevent overloading of the stock API, we will only be making watchlist updates every 10 minutes. Any request within the 10-minute window will only show the last updated watchlist

Adding Stock to Watchlist: addstock

Add a stock that you are interested in monitoring into your personal WatchList

Format: addstock /s STOCKCODE

STOCKCODEis case-insensitive.

Example of usage: addstock /s META

Example of output:

You have successfully added:

Meta Platforms Inc - Class A

Use Watchlist to view it!

- Note: Due to the free nature of the API (Alpha Vantage and FMP), only US stock prices quote will be provided by this application. Sorry for the inconvenience caused.

- Note: Due to the free nature of the API, there will be a cap of five stocks in the watchlist

- Note: StockCode should not have any spaces

Deleting Stock from Watchlist: deletestock

Delete a stock that you are no longer interested in monitoring from your personal WatchList

Format: deletestock /s STOCKCODE

Example of usage: deletestock /s META

Example of output:

You have successfully deleted:

Meta Platforms Inc - Class A

Use watchlist command to view updated Watchlist

- Note: Delete stock command is case-sensitive. Please enter the exact stock code of the stock that you have added.

- Note: StockCode should not have any spaces

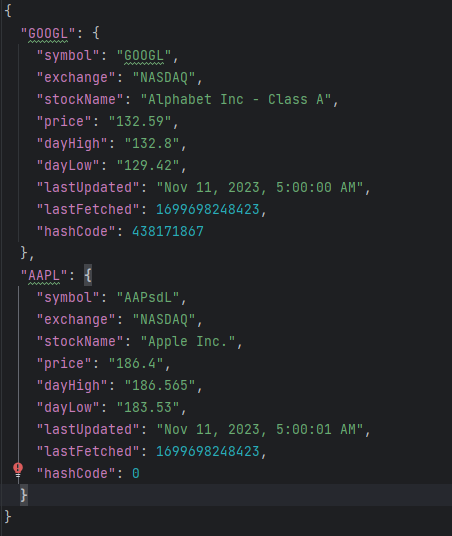

watchlist.json

You are able to read the watchlist.json populated by the Financial Planner to see the stock prices even when the application is not running

Example file content of watchlist.json:

Editing of watchlist.json

WARNING: Do not edit the json file unless you are familiar with the format of the JSON file. Incorrect format of JSON file may lead to:

- Corrupted file (user will be prompted to repair the file if he wants to)

- Deletion of stock entries that are erroneous (Financial Planner has a built-in method to remove stock entries that does not match the format specified above)

- erroneous entries present in the watchlist

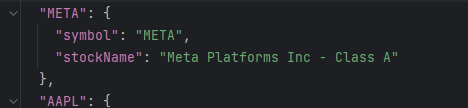

Adding stock

If you would like to add stock directly using the file, do provide accurate (we do not check for accuracy of information due to free nature of api) information for only the symbol (in uppercase) and stockName as shown below. If the format is not followed, the stock might not be loaded to watchlist upon start up.

View Reminder List: reminderlist

View your current reminder list with reminders that you have added.

Format: reminderlist

Example of usage: reminderlist

Example of output:

Here is your reminder list:

1. Reminder

Type: debt

Date: Dec 11 2023

Status: Not Done

Left Days: 28

2. Reminder

Type: loan

Date: Dec 18 2023

Status: Not Done

Left Days: 35

Add reminder: addreminder

Adds a reminder to the Financial Planner.

Format: addreminder /t TYPE /d DATE

/tis used to specify the reminder type, which describes what is the reminder used for./dis used to give a deadline date to the reminder. The date must be in the format ofDD/MM/YYYY.

Example of usage: addreminder /t debt /d 11/12/2023

Example output:

You have added Reminder

Type: debt

Date: Dec 11 2023

Status: Not Done

Left Days: 28

Delete reminder: deletereminder

Deletes a reminder from the Financial Planner.

Format: deletereminder INDEX

INDEXrefers to the index number shown in the displayed list whenreminderlistcommand is used.

Example of usage: deletereminder 1

Example output:

You have deleted Reminder

Type: debt

Date: Dec 12 2023

Status: Not Done

Left Days: 29

Mark reminder as done: markreminder

Marks a reminder as done in the Financial Planner.

Format: markreminder INDEX

INDEXrefers to the index number shown in the displayed list whenreminderlistcommand is used.

Example of usage: markreminder 1

Example output:

You have marked Reminder

Type: debt

Date: Dec 12 2023

Status: Done

Left Days: 29

View Goal List: wishlist

View your current goal list with goals that you have added.

Format: wishlist

Example of usage: wishlist

Example of output:

Here is your wish list:

1. Goal

Label: car

Amount: 5000

Status: Not Achieved

2. Goal

Label: ipad

Amount: 2000

Status: Not Achieved

Set goal: set goal

Adds a goal to the Financial Planner.

Format: set goal /g GOAL /l LABEL

/gis used to specify the goal amount./lis used to give a label to the goal.

Example of usage: set goal /g 5000 /l car

Example output:

You have added Goal

Label: car

Amount: 5000

Status: Not Achieved

Delete goal: deletegoal

Deletes a goal from the Financial Planner.

Format: deletegoal INDEX

INDEXrefers to the index number shown in the displayed list whenwishlistcommand is used.

Example of usage: deletegoal 1

Example output:

You have deleted Goal

Label: car

Amount: 5000

Status: Not Achieved

Mark goal as achieved: markgoal

Marks a goal as achieved in the Financial Planner. This operation will automatically create a corresponding expense.

Format: markgoal INDEX

INDEXrefers to the index number shown in the displayed list whenwishlistcommand is used.

Example of usage: markgoal 1

Example output:

You have achieved Goal

Label: ipad

Amount: 2000

Status: Achieved

Congratulations!

You have added an Expense

Type: Others

Amount: 2000.00

Description: ipad

to the Financial Planner.

Balance: -2000.00

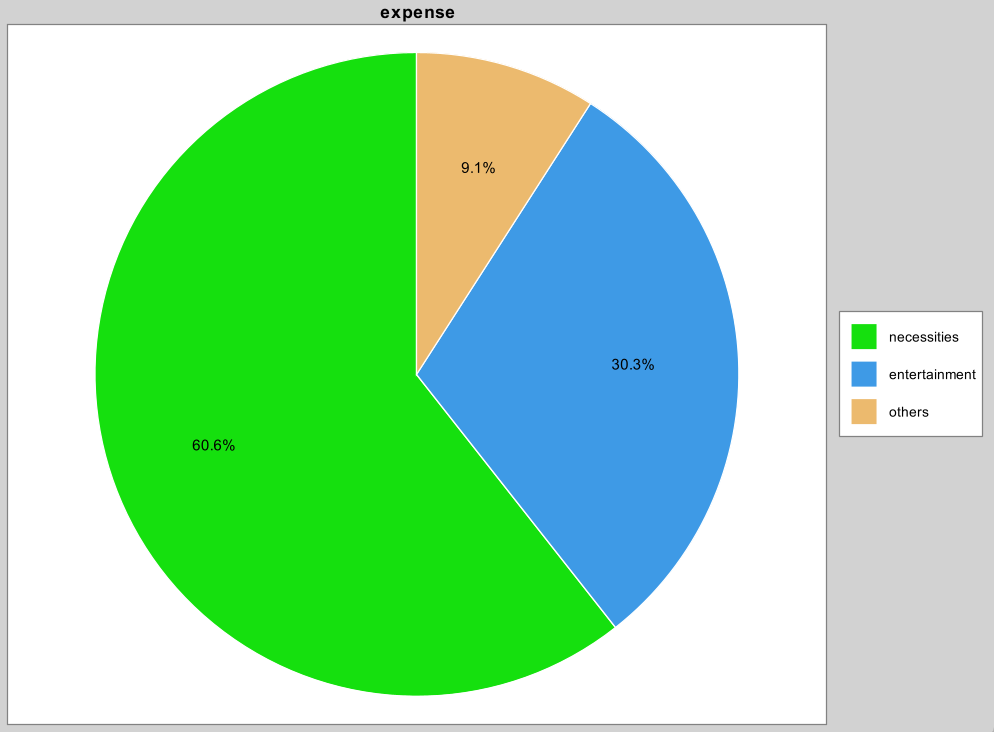

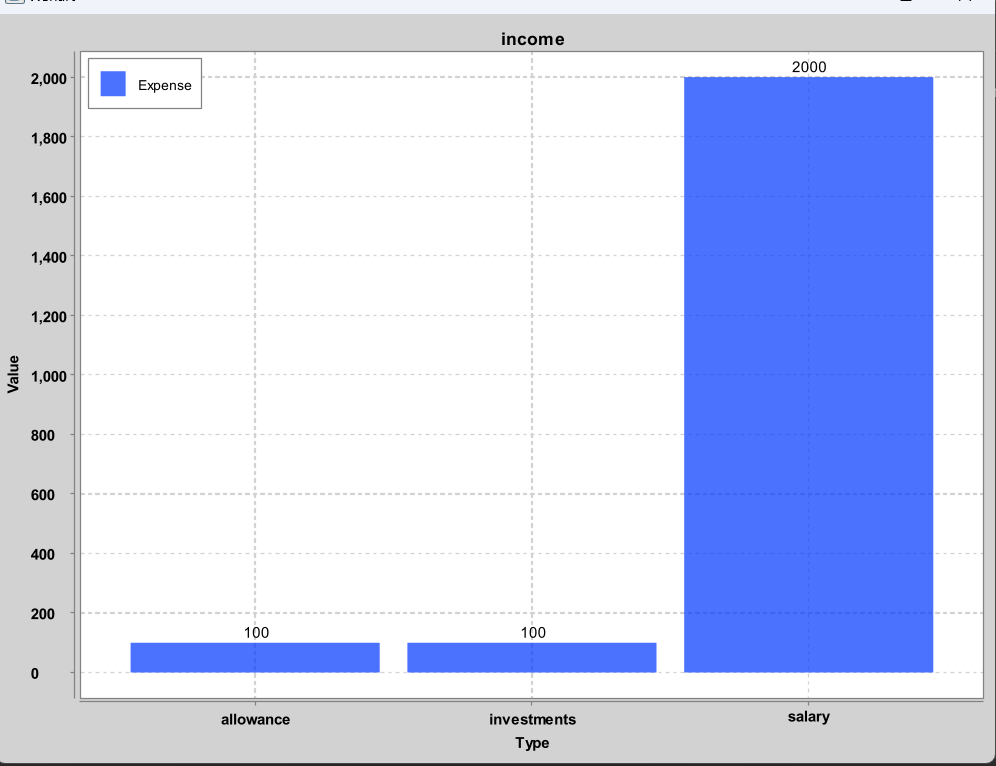

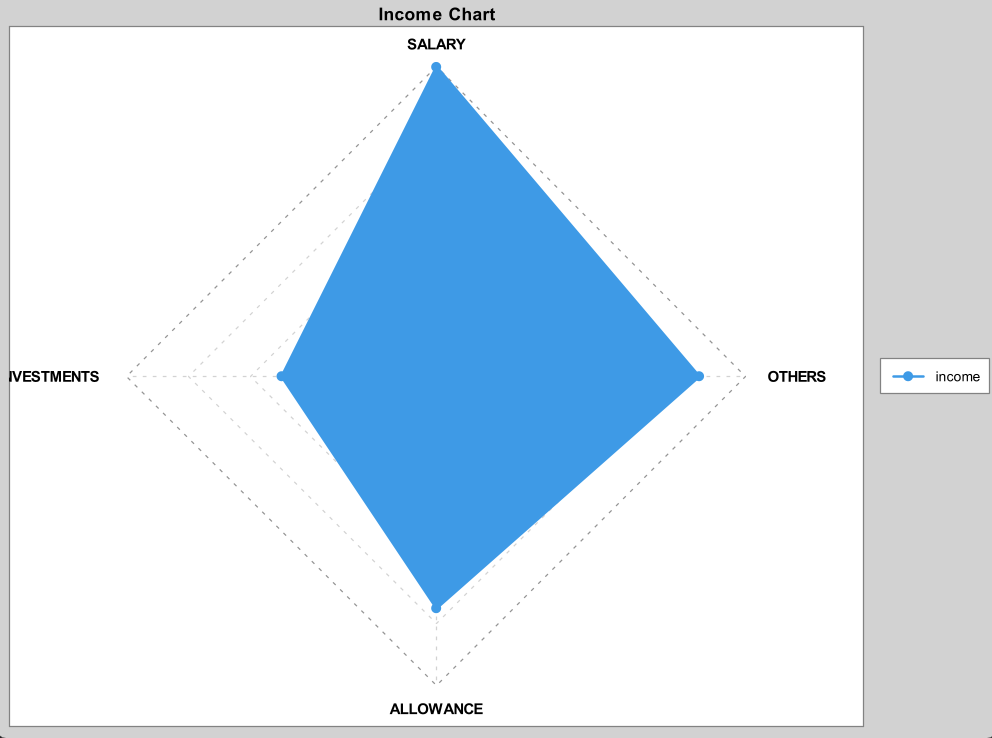

Visualizing your cashflow: vis

Using this command to visualize your income or expenses in a pie chart, bar chart or radar chart

Format: vis /t TYPE /c TOOL

Type /t |

|---|

Income Cashflows Income |

Expense Cashflows Expense |

Tool /c |

|---|

PieChart pie |

BarChart bar |

RadarChart radar |

Example of usage: vis /t expense /c pie

Example of output:

Displaying piechart for expense

Example of usage: vis /t income /c bar

Example of output:

Displaying barchart for income

Example of usage: vis /t income /c radar

Example of output:

Displaying radarchart for income

Exiting the program: exit

Exits the program.

Format: exit

Getting command help and example usage: help

Get command help and example usage. Specify the command to find help and example usage for exactly that command.

Format: help [COMMAND]

Example of usage: help budget

Saving the data

Data is automatically saved upon exiting the program using the exit command. Closing the program inappropriately

will not save the data.

Loading the data

Existing data will be automatically loaded when the program starts up.

FAQ

Q: How do I transfer my data to another computer?

A: Copy the /data/ folder from the home folder to the other computer.

Q: Should I edit the watchlist.json file?

A: You should not edit the watchlist.json file unless you are very familiar with the format used. If you would like to edit the watchlist.json file directly to manipulate your watchlist, please follow the instructions above in the watchlist feature section. However, do note that there is risk of file corruption.

Q: How is the radar chart derived?

A: To obtain the radar chart in our application, the income/expense category with the highest amount is noted. After which, amounts of all other categories are taken as a ratio of the maximum category. The ratios are then displayed in the radar chart

Q: Why can’t I add Singapore exchange stocks or other exchange stocks using the add stock command?

A: Due to the restrictions of the free API provided, only US-exchange stocks are provided. Sorry for the inconvenience caused

Q: Why is it saying that API limit is reached, not working or something like that when I use watchlist features? 🤬

A: Due to the free nature of the API, there is a restriction in the number of requests allowed in a specific time window. Sorry for the inconvenience caused. 🥲

Command Summary

| Action | Format |

|---|---|

| Add income | add income /a AMOUNT /t TYPE [/r DAYS] [/d DESCRIPTION] |

| Add expense | add expense /a AMOUNT /t TYPE [/r DAYS] [/d DESCRIPTION] |

| Delete cashflow | delete INDEX [/r] |

| Delete income | delete income INDEX [/r] |

| Delete expense | delete expense INDEX [/r] |

| Delete recurrence | delete recurring INDEX [/r] |

| list all cashflows | list |

| list all incomes | list income |

| list all expenses | list expense |

| list all recurring cashflows | list recurring |

| Set budget | budget set /b BUDGET |

| Update budget | budget update /b BUDGET |

| Reset budget | budget reset |

| Delete budget | budget delete |

| View budget | budget view |

| Display Overview | overview |

| View balance | balance |

| View Watchlist | watchlist |

| Add to watchlist | addstock /s STOCKCODE |

| Delete from watchlist | deletestock /s STOCKCODE |

| Visualization | vis /t TYPE /c CHART |

| Exit program | exit |

| Add Reminder | addreminder /t TYPE /d DATE |

| Delete Reminder | deletereminder INDEX |

| Mark Reminder as Done | markreminder INDEX |

| Add Goal | set goal /g GOAL /l LABEL |

| Delete Goal | deletegoal INDEX |

| Mark Goal as Achieved | markgoal INDEX |

| List all reminders | reminderlist |

| List all goals | wishlist |

- Note: Cashflow is referring to an income or expense

Income and Expense types

| Income | Expense |

|---|---|

salary |

dining |

investments |

entertainment |

allowance |

shopping |

others |

travel |

insurance |

|

necessities |

|

others |